Looking for something in particular at Commerce? We’ve split our programs into our core divisions below, or select All Programs to view an alphabetical list of all available Commerce programs to you.

5

Resource

5-Year Implementation Progress Report

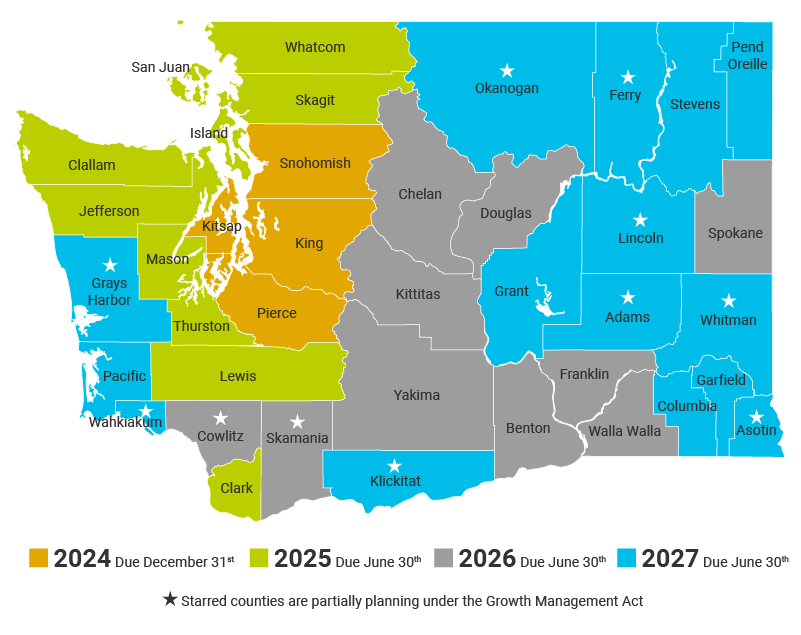

During the 2021-22 legislative session HB 1241 was adopted into law and codified as part of the Growth Management Act. This bill changed the comprehensive […]

A

Unit

Access to Capital

Small businesses require capital to grow. Unfortunately, many loan programs are designed to serve larger businesses. To close the funding gap, the Department of Commerce offers […]

Resource

Accessory Dwelling Units (ADUs)

An accessory dwelling unit (ADU) is a self-contained living space within or on the same property as a principal dwelling unit. By definition ADUs are […]

Resource

Affordable and Supportive Housing Sales and Use Tax

The 2019 Encouraging Investments in Affordable and Supportive Housing Act (RCW 82.14.540) authorized a new state-shared local tax to be used for investments in affordable […]

Group

Affordable Housing Advisory Board (AHAB)

The Washington State Affordable Housing Advisory Board (AHAB) advises the Department of Commerce on housing and housing-related issues. AHAB has 25 members representing a variety […]

Resource

Annual Point in Time (PIT) Count

The Point-in-Time (PIT) Count is an annual count of people experiencing sheltered and unsheltered homelessness carried out on one night in January. The Department of […]

Resource

Apple Health and Homes Initiative

Apple Health and Homes (AHAH) is a multi-agency effort that pairs healthcare services with housing resources for some of our most vulnerable residents. Created under Chapter […]

Resource

Appliance Standards

Appliance standards represent a cost-effective strategy to protect consumers and businesses and strengthen the state’s clean energy economy. Efficiency products save energy and water, reduce […]

Program

Asset Building Program

The Asset Building Program offers start-up support and free consultation for communities interested in building assets across Washington.

Resource

Assistance, Coordination and SYNC

In 2017, the Legislature passed ESHB 1677 (PDF), creating an interagency, multijurisdictional system improvement team known as SYNC. SYNC must “identify, implement, and report on […]

Resource

Associate Development Organizations (ADOs)

The Department of Commerce team of economic development experts works closely with our local and regional partners to coordinate recruitment, promote Washington State, respond to […]

B

Resource

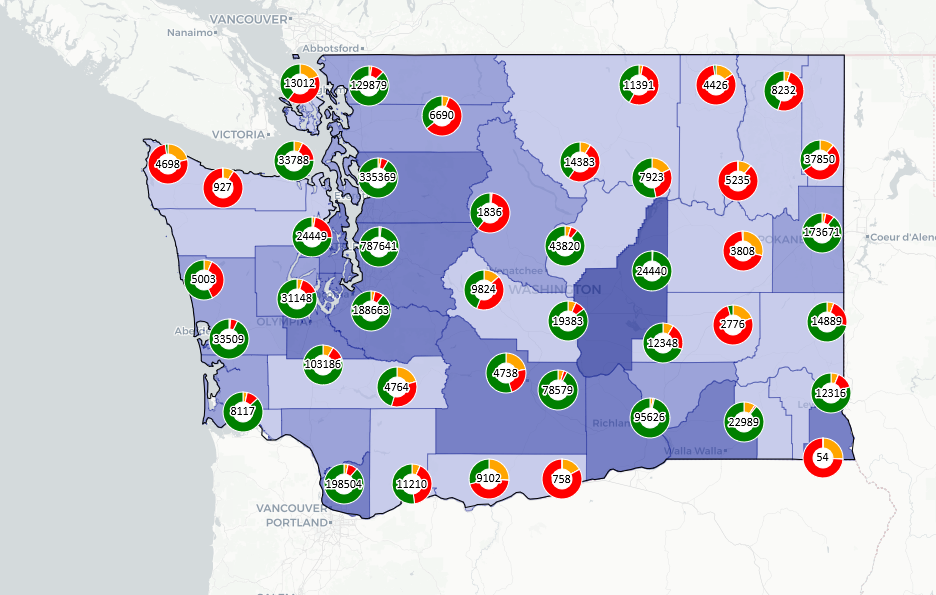

BEAD Challenge

Welcome to Washington’s Broadband Equity, Access, and Deployment Program (BEAD) Challenge Page. We will conduct a required state challenge process during the spring of 2024. This […]

Program

Behavioral Health Facilities Program

Our grants establish new behavioral health service capacity in communities through acquisition, renovation, or new construction of real property.

Resource

Behavioral Health Model Ordinance Project

The Department of Commerce was charged by the Washington State Legislature per ESSB 6168 (2020), Section 127 (27) to develop a model ordinance for cities […]

Program

Bond Cap Allocation Program

Since its inception in 1987, the Bond Cap Allocation Program has approved more than $16.9 billion in tax-exempt private activity bonds and has been responsible […]

Resource

Bond User’s Clearinghouse

The Bond User’s Clearinghouse provides a wealth of data on bond issuances and local government debt across Washington, as required by Chapter 39.44 RCW. New […]

Resource

Broadband Resources and Funding

Three agencies provide funding for broadband. Learn more about each agency's role and funding cycles.

Program

Brownfields Revolving Loan Fund

The Brownfields Revolving Loan Fund (RLF) provides low interest loans to local governments, non-profits, tribes, ports, and private businesses undertaking clean-up of contaminated properties. The […]

Resource

Build My Export Plan

The first step to successfully exporting is to develop a written plan. The process of thinking through the important questions highlighted below can help you […]

Program

Buildable Lands Program

Included as a component of the Growth Management Act (GMA) in 1997, the Review and Evaluation Program under RCW 36.70A.215 is often referred to as […]

Program

Building Communities Fund Program

State grants are available to nonprofit, community-based organizations to defray eligible capital costs to acquire, construct, renovate or rehabilitate nonresidential community and social service centers.

Program

Building Efficiency and Clean Operations Network (BEACON) Fellowship Project

Commerce partnered with the Smart Buildings Center Education Program, Strategic Energy Innovations (SEI), and San Timoteo Energy Associates, to develop and implement the innovative BEACON […]

Program

Building for the Arts Program

Since 1991, the state has awarded award grants to nonprofit performing arts, art museum and cultural organizations.

Resource

Business and Homeowner Resources for Lead-Based Paint

Whether you’re a business owner managing lead-safe projects or a homeowner looking to protect your family from lead hazards, Commerce offers the tools and resources you need to stay informed and lead-safe.

Unit

Business Development

Business recruitment, retention and expansion. We drive economic growth by building business organically and attracting new business investment into Washington state. Part of the Office […]

Resource

Buy Clean and Buy Fair (BCBF)

Washington’s Buy Clean and Buy Fair law represents a crucial step in the state’s broader, ongoing commitment to combating climate change and building a clean […]

C

Resource

Capacity Building, Outreach and Support Program (CBOS)

Everyone needs a safe and affordable place to live, and Commerce is committed to ensuring fair and equitable access to resources that support housing development. […]

Resource

Capital Facilities Planning

Capital facilities plans can help your jurisdiction use its limited funding wisely and most efficiently to maximize your funding opportunities. By planning ahead to determine […]

Resource

CBPS Clean Buildings Portal

The Clean Buildings Portal is a database of all covered buildings. It provides Tier 1 building owners with a secure system to manage their building’s […]

Program

CBPS Incentives

The Early Adopter Incentive program provides incentives to building owners who demonstrate early compliance with the Clean Buildings Performance Standard (CBPS). The Tier 1 Early […]

Resource

CBPS Rulemaking, Trainings and Workgroup

Resources Office Hours A dedicated space outside of our scheduled trainings and workshops to connect with our Clean Buildings staff, ask questions, talk through scenarios […]

Resource

CBPS Support and Resources

Commerce serves as the administrator of the Clean Buildings Performance Standard (CBPS). We are also here for technical assistance. The building owner is responsible for […]

Resource

CCF Grantee Funding Toolkit

This toolkit describes the conditions of funding and processes applicable to all Community Capital Facilities (CCF) grants. Requirements are grouped by phase in the grant […]

Program

CDBG Coronavirus Funds

The federal Coronavirus Aid, Relief, and Economic Security Act (CARES Act) has allocated 38M in supplemental CDBG-Coronavirus (CDBG-CV) funds through the US Department of Housing […]

Program

CDBG Disaster Recovery Funds

Community Development Block Grant- Disaster Recovery is a federal grant program administered by the U.S Department of Housing and Urban Development (HUD). Its purpose is […]

Program

CDBG General Purpose Grants

CDBG General Purpose grants are open on an ongoing basis, as funds are available. Funding is to assist eligible Washington State small cities, towns, and […]

Resource

CDBG Plans and Reports

Consolidated Plan, Annual Action Plan, and the Performance and Evaluation report (PER) are designed to help states assess their affordable housing and community development needs, […]

Resource

CDBG Project Resources

Resources to provide guidance and assist in the management of CDBG-funded construction and non-construction projects are available. Management handbook Guidance materials

Program

CDBG Public Services Grants

The state CDBG program annually awards Public Services Grants to 17 non-entitlement counties throughout Washington State. These grants support partnerships with regional community action agencies […]

Program

CERB Committed Private Partner Program (CPP)

Loans and grants for construction of public infrastructure necessary for private business expansion. Funding availability CERB offers loans at $5 million maximum per project. Grants […]

Program

CERB Planning Program (PP)

CERB provides limited grant funding for studies to evaluate high-priority economic development projects, and rural broadband projects. When considering planning grants, the Board gives priority […]

Program

CERB Prospective Development Program (PD)

The Prospective Development (PD) program serves rural communities by offering grant loan project funding to local governments and federally recognized Indian tribes. Funding availability The […]

Program

CERB Rural Broadband (RB)

CERB provides low-interest loan/grant packages to local governments and federally recognized Indian tribes, financing the cost to build infrastructure to provide high-speed, open-access broadband service, […]

Program

CHG Technical Assistance and Training

Below are presented technical assistance and training resources for Consolidated Homeless Grant (CHG) grantees and subgrantees to support effective utilization of awarded funding. CHG is […]

Program

Child Care Partnership Grants

Child Care Partnership Grants (CCPG) support local communities to expand access to affordable, high-quality child care, especially for underserved and historically marginalized communities. Through strategic […]

Resource

Civilian-Military Land Use Compatibility

Growth Management Services supports civilian-military communication in local planning as a critical means of identifying community and military interests in future land-use development.

Program

Clean Building Performance Grants

The Clean Buildings Performance Grants program offers competitive funding for energy efficiency improvements in both private and public buildings that are working toward complying with […]

Resource

Clean Buildings Performance Standard (CBPS)

Clean buildings are essential to meeting our state energy goals. In 2019 the Clean Buildings bill was signed into law, expanded in 2022, and augmented […]

Program

Clean Energy Ambassadors

Commerce hosted a series of nine statewide community workshops in fall 2024 to listen and learn from communities and tribes about their visions and barriers […]

Resource

Clean Energy Transformation Act (CETA)

On May 7, 2019, Governor Jay Inslee signed the Clean Energy Transformation Act (CETA) (SB 5116, 2019) into law, which commits Washington to an electricity […]

Unit

Clean Transportation

Transportation is the state’s number one source of greenhouse gas emissions and a major source of local air pollution that disproportionately impacts the health of […]

Resource

Clearinghouse on Human Trafficking

The Washington State Clearinghouse on Human Trafficking provides information on statewide efforts to combat trafficking and resources for victims and survivors. Its primary goal is to share and coordinate statewide efforts to combat human trafficking.

Resource

Climate Commitment Act (CCA)

The Climate Commitment Act (CCA) is Washington’s cap-and-invest program. It requires Washington’s largest emitting businesses to purchase allowances equal to their covered greenhouse gas emissions […]

Resource

Climate Planning

This page provides planning guidance, grants and other resources for developing a climate element that mitigates greenhouse gas emissions and builds community resilience.

Program

Climate Pollution Reduction Grant Program (CPRG)

The federal Climate Pollution Reduction Grant Program (EPA.gov) is one of many federal funding opportunities created through the Inflation Reduction Act and run through the U.S. Environmental Protection Agency (EPA). […]

Resource

Collaborative Roadmap

The Collaborative Roadmap is a multi-year research and analysis project led by Commerce as directed by the Legislature to make recommendations to update the state's growth policy framework.

Group

Community Advisory Team (CAT)

The Community Advisory Team (CAT) is a subcommittee of the Affordable Housing Advisory Board (AHAB). It serves as a hub for gathering community input and […]

Program

Community Behavioral Health Rental Assistance Program (CBRA)

The Community Behavioral Health Rental Assistance (CBRA) program provides a long-term rental subsidy for high-risk individuals and households with behavioral health conditions. When combined with […]

Unit

Community Capital Facilities

You may not think about the Department of Commerce when your school gets a new Heating Ventilation and Air Conditioning (HVAC) system, or when the […]

Program

Community Development Block Grants (CDBG)

The CDBG program improves the economic, social and physical environment of eligible, rural cities and counties to enhance the quality of life for low- and […]

Unit

Community Economic Opportunities

The Community Economic Opportunities (CEO) Unit is improving communities across Washington state.

Unit

Community Economic Revitalization Board (CERB)

The Community Economic Revitalization Board (CERB) was formed in 1982 to respond to local economic development in Washington communities. CERB provides funding to local governments and […]

Unit

Community Reinvestment Project (CRP)

The Community Reinvestment Project (CRP) is a community-designed plan to uplift communities disproportionately harmed by the war on drugs.

Unit

Community Safety

The Community Safety Unit includes the Office of Firearm Safety and Violence Prevention with a focus on programs designed to reduce firearm violence, enhance public […]

Program

Community Services Block Grant (CSBG)

Community Services Block Grants (CSBG) aims to help individuals and families meet their basic needs, achieve self-sufficiency, and improve their community in the ways that […]

Program

Community-Law Enforcement Partnership Program (CLEP)

The Washington Legislature created the Community-Law Enforcement Partnership (CLEP) program in 2021 to foster community engagement through neighborhood organizing, law enforcement and community partnerships, youth […]

Program

Connecting Housing to Infrastructure Program (CHIP)

The Connecting Housing to Infrastructure Program (CHIP) was created in 2021 to fund utility connections to affordable housing. The program helps local governments encourage the […]

Program

Consolidated Homeless Grant

The Consolidated Homeless Grant (CHG) provides resources to fund homeless crisis response systems. Grants are made to local governments and nonprofits. Recipients of these funds […]

Resource

Continuum of Care

The Washington State Department of Commerce is the Collaborative Applicant for the Washington Balance of State Continuum of Care (BoS CoC). The goal of the […]

Resource

Coordinated Entry

Coordinated Entry (CE) is a process that promotes system-wide coordination for a more effective and strategic response to homelessness. CE helps a crisis-response system transition […]

Resource

Crime Victim Resource Directory

The Crime Victim Resource Directory provides information on the victim services currently funded by the Office of Crime Victim Advocacy. Please use this directory to find relevant, local victim services.

Unit

Crime Victims Advocacy

The Office of Crime Victims Advocacy (OCVA) serves as a voice within government for the needs of crime victims in Washington. We envision a future where all people have access to support, healing, and the ability to reach their full potential; where all people experience autonomy, dignity, freedom of identity and expression, and safety in their homes and communities.

Program

Crime Victims Grants and Funding

Commerce’s Office of Crime Victims Advocacy provides direct and competitive grants to organizations across Washington state providing services to survivors and victims of crime.

Resource

Critical Areas Protection

The Growth Management Act (GMA) requires all cities and counties to adopt development regulations that protect critical areas. These regulations help to preserve the natural […]

D

Resource

Dash Point and Browns Point Incorporation Study

In 2024, the Legislature formally requested that the Washington State Department of Commerce study the impacts of incorporating the unincorporated communities of Dash Point and […]

Resource

Decarbonization of District Energy Systems

Washington is leading the nation with existing building performance standards. The legislature recognizes that building decarbonization is necessary to achieve the state’s climate goals. Thus, […]

Program

Defense Community Compatibility Account (DCCA)

The 2019 Legislature created the Defense Community Compatibility Account (DCCA) with to support necessary infrastructure and support compatible land use and infrastructure near military installations […]

Group

Developmental Disabilities Council (DDC)

The Developmental Disabilities Council (DDC) advocates for better services and supports for people with developmental disabilities and their families. The DDC’s job is to understand […]

Group

Digital Equity Forum

Washington is listening to community ideas for ways to advance digital equity. Access to broadband services is essential and Washington residents are still struggling to […]

Program

Digital Navigator Program

The Digital Navigator Program leads collaborative partners implementing activities to eliminate barriers providing a path forward in equitable digital inclusion with increased access to supporting […]

Group

Disabilities Workgroup

The Disabilities Workgroup supports the Achieving a Better Life Experience (ABLE) Program and the Developmental Disabilities Endowment Trust Fund (DDETF) Governing Boards.

Program

Dispute Resolution Program

The Dispute Resolution program offers an alternative to resolving common disputes without resorting to civil court mediation by providing funding to support the delivery of […]

Resource

Drive-In WiFi Hotspots

Broadband equity is not just a rural challenge. The drive-In Wi-Fi hotspot project addresses underserved and economically disadvantaged communities in urban and suburban areas as […]

E

Program

Early Learning Facilities Program

The Early Learning Facilities program supports Washington's commitment to develop additional high quality early learning opportunities for children from low-income households.

Resource

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) helps low-to-moderate income workers and families get a tax break. Many people in Washington are eligible for EITC, and this credit is potentially worth thousands of dollars.

Program

Economic development with CRP

CRP's economic development program is repairing wealth disparities in communities disproportionally harmed by the war on drugs. This includes creating opportunities for individuals and families to buy homes, save money, receive financial education, training and grants for small businesses.

Program

Ecosystem Planning

The Ecosystem Services program is responsible for implementing natural environment protection and restoration policy in the Growth Management Act. This includes critical areas protection, and […]

Group

Electric Vehicle Coordinating Council (EVCC)

The Interagency Electric Vehicle Coordinating Council (EV Council) was established in 2022 to enable state agencies to collaborate on accelerating electric vehicle adoption and reducing […]

Program

Emergency Solutions Grant Program (ESG)

The Emergency Solutions Grant (ESG) program utilizes federal funds to support communities in providing street outreach, emergency shelter, rental assistance, and related services. This program […]

Resource

Emissions Performance Standard (EPS)

The emissions performance standard (EPS) is a set of state-imposed rules to a limit the amount of CO2 that each power station may emit to […]

Group

Energy and Climate Policy Advisory Committee

Pursuant to a proviso in section 23 of the Clean Energy Transformation Act, the Department of Commerce convened the Energy and Climate Policy Advisory Committee. […]

Program

Energy Audit Incentive for Public Buildings Program

Energy audits are conducted to identify cost-effective energy efficiency measures. Building owners can use these audits to save energy, comply with the Clean Buildings Performance […]

Program

Energy Efficiency Conservation Block Grants Program (EECBG)

Capacity-building planning grants for local governments Washington received funding to pass through $2,046,501 in federal formula funding for the federal EECBG program to cities and […]

Program

Energy Efficiency Retrofits Grants

Energy Efficiency grants provide competitive funding for energy efficiency improvements at public buildings and facilities, such as schools, hospitals, community centers, affordable housing, and wastewater […]

Unit

Energy Incentives for Residential Homes and Clean Buildings

Commerce programs focusing on improving energy efficiency in public and residential buildings, supporting weatherization efforts for low-income households, and promoting community-wide energy efficiency. These initiatives […]

Resource

Energy Independence Act (EIA)

The Energy Independence Act (EIA or I-937) requires electric utilities serving at least 25,000 retail customers to use renewable energy and energy conservation.

Unit

Energy Policy, Standards and Reports

State energy policies, standards, and reports are essential tools for managing and guiding the production, distribution and consumption of energy for the state.

Unit

Energy Programs in Communities (EPIC)

The Energy Programs in Communities (EPIC) unit, a part of the Energy Division and State Energy Office, designs, develops and implements initiatives that enable all […]

Unit

Energy Resilience and Emergency Management

Electricity is essential to our daily life and is the lifeline for our communities. Electricity pumps clean drinking water and operates our wastewater treatment plants; […]

Program

Energy Resilience Technical Assistance Program

The Washington Energy Resilience Technical Assistance Program provides direct technical assistance to communities as they explore improving community resilience with energy system solutions. We help […]

Program

Equitable Access to Credit Program

The Equitable Access to Credit Program, a tax credit program, awards grants to qualified lending institutions to provide businesses in historically underserved communities with access […]

Resource

Evergreen Sustainable Development Standard (ESDS)

The Evergreen Sustainable Development Standard (ESDS) is a building performance standard that all affordable housing projects that receive capital funds through the state Housing Trust Fund […]

Unit

Export Assistance

Washington State is one of the country’s major export hubs, exporting nearly $80 billion in goods annually. The Department of Commerce offers businesses an experienced trade […]

F

Program

Family-Friendly Workplaces

The Employer-Supported Child Care Technical Assistance Program (also known as Family-Friendly Workplaces) offers professional, no-cost business consultations that support employers in becoming family-friendly. The current […]

Resource

FCC National Broadband Map

The Federal Communications Commission (FCC) has published a new FCC National Broadband Map. This map attempts to show where internet service is and is not […]

Program

Federal Clean Energy Tax Assistance Program (CETCAP)

Washington offers a program that supports clean energy projects to help organizations access key federal tax incentives from the Inflation Reduction Act. The federal Inflation […]

Resource

Federal Funding for Clean Energy

The 2021 Infrastructure Investment and Jobs Act (also known as the Bipartisan Infrastructure Law) and the 2022 Inflation Reduction Act (PDF) represent unprecedented federal investment […]

Program

Federal Funds Grant Writing Assistance Program (FFGWAP)

FFGWAP is a program that supports access to federal funds grant writing assistance for communities across the state. The Washington Department of Commerce, in partnership […]

Resource

File a tip or complaint about lead-based paint

Help us protect communities and ensure compliance with lead-safe practices by submitting a tip or complaint. Anyone can report concerns about unsafe or improper lead-based […]

Resource

Firearm Violence Data

Understanding firearm-related violence data is important in policymaking decisions. Using state and federal data sources, the Office of Firearm Safety and Violence Prevention created a […]

Program

Foreclosure Fairness Program

The Foreclosure Fairness Program provides homeowner foreclosure assistance through free housing counseling, civil legal aid, and foreclosure mediation. The program, created by the 2011 Foreclosure […]

Resource

Foreign Direct Investment (FDI)

Foreign investment is humming right along nationwide. After a slight drop during the Great Recession, investments are strong once again, topping $373.4 billion nationwide. Washington […]

Program

Fuel Mix Disclosure

Washington electric suppliers and utilities are required to inform customers about the fuels used to generate the electricity they sold in the previous year. This […]

Program

Funding Opportunities for Multifamily Rental Housing

Funding opportunities for the WA Housing Trust Fund (HTF), National Housing Trust Fund (NHTF), HOME Rental development program, and Housing Preservation Program are posted annually. […]

G

Resource

GMA Laws and Rules

The Washington State Growth Management Act requires cities and counties to develop comprehensive plans and development regulations for their communities. This page serves as a […]

Program

GMS Mediation Services

The GMS Mediation Services program offered by Growth Management Services provides support for resolving disputes that arise during planning. Mediation Services provides two main categories […]

Program

Governor’s Smart Communities Awards

The Governor’s Smart Communities Awards recognize outstanding efforts of local communities and their partners throughout the state, creating vibrant and livable communities by achieving the […]

Program

Grid Resilience and Reliability

Authorized by the Bipartisan Infrastructure Law, the Grid Resilience State and Tribal Formula Grants program (often referred to as section 40101(d)) is designed to strengthen […]

Unit

Growth Management

Growth Management Services (GMS) serves to assist and guide local governments, state agencies, and others to manage growth and development, consistent with the Growth Management Act (GMA).

H

Program

Hanford Area Economic Investment Fund (HAEIF)

The mission of the Hanford Area Economic Investment Fund (HAEIF) is financing projects that expand and diversify local industry and create living wage jobs in […]

Resource

HB 1217 Landlord Resource Center

HB 1217 of the 2025 legislative session directed Commerce to create an “online resource center to distribute information to landlords about available programs, associated services […]

Resource

HEAL Act and Environmental Justice

Since the beginning of the Governor’s Environmental Justice Taskforce in 2019, Commerce has helped advance the state’s initiatives aimed at addressing environmental injustices. With a […]

Program

Home Rehabilitation Grant Program (HRGP)

The Home Rehabilitation Grant Program (HRGP) provides funding to assist individuals with home-repair improvements that address health, safety and durability issues in homes in rural […]

Program

HOME Rental Development Program

The U.S. Department of Housing and Urban Development (HUD) HOME Rental Development program is a housing block grant program used to preserve and create affordable […]

Group

Homeless Councils

The Department of Commerce provides administrative support to two advisory councils related to homelessness: the State Advisory Council on Homelessness (SACH) and the Interagency Council […]

Resource

Homeless Management Information System (HMIS)

State and federally-funded homeless and housing service providers use HMIS to collect and manage data gathered while providing housing assistance to people already experiencing homelessness […]

Program

Homeless Student Stability Program (HSSP)

The Legislature established the Homeless Student Stability Program (HSSP) in 2016 with passage of the Homeless Student Stability and Opportunity Gap Act, which amended state […]

Resource

Homeless System Performance

Performance measures help evaluate the effectiveness of homeless crisis response systems as they work to ensure that homelessness is rare, brief and one time. Commerce identifies […]

Group

Homeless Youth Prevention and Protection Advisory Committee

OHY’s work is guided by Homeless Youth Prevention & Protection (HYPP) Advisory Committee recommendations regarding funding, policy, and practice gaps within and among state programs […]

Program

Homelessness Diversion Program

The Diversion Program is a critical resource in the homeless crisis response system. This grant provides funding for diversion services to any non-profit organization and […]

Group

Homelessness Lived Experience Advisory Committee

The Homelessness Assistance Unit (HAU) Lived Experience Advisory Committee provides insight, perspective, ideas and recommendations that make homeless crisis response systems across Washington better, stronger, […]

Unit

Homelessness Response

In Washington, the response to homelessness consists of federal, state-wide, and local efforts. Commerce provides a framework to ensure alignment of the various initiatives at […]

Unit

Homeownership

Commerce’s Homeownership Unit works to create and maintain strong, sustainable, inclusive communities through homeownership opportunities. Department of Commerce support ranges from capital funding to build […]

Program

Homeownership Capital Programs

The Homeownership Capital Program provides capital funding through the Housing Trust Fund for various programs to provide homeownership opportunities to low-income first-time homebuyers. For detailed […]

Group

Homeownership Disparities Workgroup

In the 2021-23 Operating Budget, the Legislature tasked the Department of Commerce with convening a diverse homeownership-focused work group to “assess perspectives on housing and […]

Unit

Housing Data and Systems Performance

The Housing Division’s Data and Performance Unit collects and analyzes data to evaluate the effectiveness of housing and homeless services, and to help prevent and end […]

Program

Housing Preservation Program

The Housing Preservation Program makes funds available for major building improvements, preservation renovations or upgrades, and system replacements necessary for existing Commerce-funded multi-family rental projects. […]

Program

Housing Trust Fund (HTF) Repair Fund

Affordable housing preservation is a key priority to Commerce and the Washington State Legislature. In 2024, the Legislature directed Commerce to provide funds for emergency […]

Resource

Housing Trust Fund Program (HTF)

Since 1986, the state’s Housing Trust Fund has invested over $2 billion in capital funding and helped build or preserve more than 58,600 affordable housing […]

Resource

Hydrogen and Renewable Fuels

Green hydrogen and renewable fuels offer a pathway to reduce harmful greenhouse gas emissions and achieve clean energy targets for the hardest-to-decarbonize sectors of Washington’s […]

I

Resource

Industry Trade Shows

Trade shows expand your business Gain exposure to new global markets. Washington State competes with the other 49 states in the U.S. for new business […]

Resource

Inflation Reduction Act Home Energy Rebates

The Inflation Reduction Act (IRA) Home Energy Rebates programs provide rebates for home improvements like energy efficiency and home electrification measures. The rebates are for […]

Resource

InfoNet

The Washington InfoNet is a web-based data collection system for victim service providers to report on the clients they serve and the myriad services they […]

Resource

International Trade Missions

Trade missions are a critical tool for marketing the state. As much as technology has changed the way business is conducted, many cultures still require […]

Resource

Internet for All Initiative

The Washington State Broadband Office led a state planning process to develop a Five-Year Action Plan (PDF) and a State Digital Equity Plan (PDF). These […]

J

Program

Justice Assistance Grant Program (JAG)

The Edward Byrne Memorial Justice Assistance Grant Program (JAG) is the leading source of federal justice funding to state and local jurisdictions. The Department of […]

K

Group

Keep Working Washington

The Working Washington program was formed in response to the Keep Washington Working Act of 2019. It addresses statewide policy on supporting Washington’s economy and […]

Unit

Key Industries

Washington’s economy is vibrant and full of transformational entrepreneurs who changed the way we do business across the globe. With more than a half million […]

L

Program

Landlord Damage Relief Program

Washington state’s Landlord Mitigation Law (RCW 43.31.605) became effective on June 7th of 2018 to provide landlords with an incentive and added security to work […]

Unit

Landlord Mitigation Program

The Landlord Mitigation Program launched in 2018 originally offering damage relief to landlords that provide housing to tenants that are receiving rental assistance. Over the […]

Program

Landlord Survivor Relief Program

The Landlord Survivor Relief program can award payments of up to $5,000 for damages directly to the landlord when the conditions below are met. Any […]

Resource

LBPA and RRP Training for Lead-Based Paint

Training is required to become certified to work with lead-based paint. Learn more about LBPA and RRP certification.

Program

Lead-Based Paint

The Department of Commerce regulates certification, accreditation, enforcement and compliance for firms and individuals who must use lead-safe work practices. Lead-safe work practices are required when working on pre-1978 homes or child-occupied facilities.

Program

Lead-Based Paint Activities (LBPA) Program

If your work involves inspecting, assessing, or addressing lead-based paint hazards in pre-1978 homes or child-occupied facilities, you need Lead-Based Paint Activities Certification.

Program

Legal Aid for Immigrants

Commerce supports legal aid providers for low-income immigrants who are at the most risk of harm.

Program

Legal Assistance with CRP

CRP is funding civil and criminal legal assistance to provide post-conviction relief and case assistance for communities disproportionally harmed by the war on drugs.

Resource

Legislative Resources

We are the lead state agency charged with enhancing and promoting sustainable community and economic vitality in Washington. We administer a diverse portfolio of more […]

Program

Library Capital Improvement Program

The Library Capital Improvement Program was created by the Legislature in their 2019 Regular Session to assist libraries operated by governmental units to acquire, construct, or rehabilitate their facilities.

Resource

Local Government Fiscal Note Program

The Local Government Fiscal Note Program helps elected leaders understand the fiscal impacts that proposed state legislation could have on counties, cities, and special purpose […]

Resource

Local Government Portal

This page outlines funding programs, training, and technical assistance services to help your community grow.

Resource

Local Jurisdiction Fuel Planning

EREMO has developed guidance to help public and private entities in the state of Washington estimate their fuel consumption in an emergency and develop a […]

Resource

Local Project Review

The Local Project Review Act was established in 1995 as the statewide framework for local government land use planning review and development permitting. Fundamental land […]

Program

Low-Income Home Energy Assistance Program (LIHEAP)

LIHEAP aims to help low-income households in Washington receive affordable, dependable utility services and avoid disconnection.

M

Program

Manufactured/Mobile Home Relocation Assistance Program

If you own your manufactured or mobile home and live in a community closing in Washington, you may be eligible for relocation assistance and coordination […]

Program

Multi-Family Housing Property Tax Exemption Program (MFTE)

The Multi-Family Housing Property Tax Exemption (MFTE) program provides a property tax exemption in exchange for the development of multifamily and affordable housing in designated […]

Unit

Multifamily Rental Housing

The Washington State Department of Commerce is committed to creating and preserving affordable housing for Washingtonians of all backgrounds. Washington, like many other states, has […]

N

Program

National Housing Trust Fund Program (NHTF)

The U.S. Department of Housing and Urban Development (HUD) National Housing Trust Fund (NHTF) program complements existing federal, state and local efforts to build, preserve […]

Resource

Natural Resource Lands

All local governments in Washington state need to determine where natural resource industries, including forestry, agricultural, mining, and fisheries industries, can productively operate. They must […]

O

Group

Office of Firearm Safety and Violence Prevention (OFSVP)

The Department of Commerce is committed to building strong communities to support successful businesses and self-sufficient families. Strengthening communities is at the heart of our […]

Group

Office of Tribal Relations (OTR)

Tribal communities have been the stewards of the lands of Washington State since time immemorial. The Department of Commerce respects their continued stewardship and actively […]

Group

Ombuds Workgroup

The ombuds programs support people experiencing issues with service providers while receiving long term care, behavioral health, or developmental disability services. The Department of Commerce […]

Program

Operating and Maintenance Funds Programs

The Department of Commerce administers two programs that fund building operations and regular maintenance. The traditional Operating and Maintenance (OM) program awards up to $50,000 […]

Program

Outreach Grants

Commerce is strengthening communities across Washington by providing grants to community-based organizations with experience and cultural skills to enroll people historically excluded from state and federal social services.

P

Resource

Periodic Update

This page is dedicated to the Growth Management Act Periodic Update. We post checklists, guidance documents and other GMA related support materials here on a regular basis to help local governments with their reviews

Unit

Permanent Supportive Housing

The United States Interagency Council on Homelessness stated that Permanent Supportive Housing (PSH) is an intervention for people who need housing assistance and supportive housing […]

Group

Permanent Supportive Housing Advisory Committee

Permanent supportive housing (PSH) is defined in RCW 36.70A.030 (31) as non-time-limited housing for persons with disabling conditions who have experienced homelessness or risk of homelessness and […]

Resource

Planners’ Forums

The Planners’ Forums are a combined effort on behalf of Department of Commerce, the Planning Association of Washington, and the Washington Chapter of the American […]

Program

Planning and Predesign Capital Equity Program

Commerce has many programs that fund the construction of capital projects and capital projects require planning and predesign activities prior to any award being made. […]

Resource

Planning for Middle Housing

This page provides guidance, model ordinances and other resources to assist local jurisdictions in developing middle housing regulations for their communities.

Program

Public Facility Feasibility Reviews Program

Commerce manages the public facilities district (PFD) independent financial feasibility review program, as required by Chapter 36.100.025 RCW and Chapter 35.57.025 RCW. The requirement went into effect […]

Resource

Public Retail Broadband

Towns, second class cities and counties Under Engrossed Substitute House Bill 1336, a town, second class city, or county may construct, purchase, acquire, develop, finance, […]

Unit

Public Works Board

Since its founding in 1985, the Public Works Board (PWB) has awarded more than $3.6 billion in loans and grants to over 2,200 infrastructure projects […]

Resource

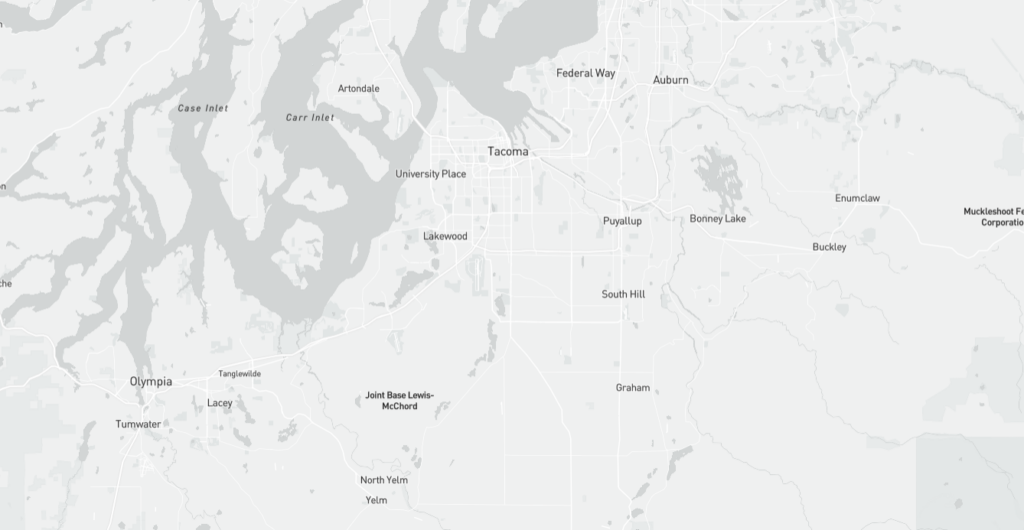

Puget Sound Mapping Project

The Puget Sound Mapping Project provides a mapping tool for regional and local governments that shows growth patterns around the Puget Sound Region using consistent methods across cities and counties.

Resource

PWB Broadband Financing

The Public Works Board (Board) Broadband program is authorized by state statute (RCW 43.155.160). Its purpose is to loan and grant funding to promote the […]

Resource

PWB Traditional Financing

The Public Works Board (Board) is authorized by state statute (RCW 43.155). Its purpose is to loan and grant money to counties, cities, and special […]

R

Program

Reentry Grant Program

In 2021, the Washington State Legislature created the Reentry Grant Program, appropriating $5 million to the Department of Commerce “to administer a competitive grant program […]

Program

Reentry Services with CRP

Reentry services are proven to increase the likelihood of successful reentry for individuals who are transitioning from incarceration back into their communities.

Resource

Regional Resiliency Assessment Program (RRAP)

The Regional Resiliency Assessment Program (RRAP) is a voluntary, cooperative assessment among public and private sector partners of targeted critical infrastructure that identifies a range […]

Program

Religious and Nonprofit Security Grant

The Religious and Nonprofit Security Grant program pays for security equipment, training, and other critical safety needs for faith organizations and nonprofits targeted because of their mission, ideology, or beliefs.

Program

Renovation, Repair and Painting (RRP) Program

The Renovation, Repair and Painting certification (RRP) aims to minimize exposure to lead-based paint dust during renovation, repair, or painting activities.

Unit

Research and Development Services

The Research and Development Services Unit includes several municipal research programs, the division’s securitization team, as well as a research and project management services team. […]

Group

Resource Adequacy

At least once a year, Commerce and the UTC hold a meeting with representatives of investor- and consumer-owned utilities, regional planning organizations, transmission operators, and […]

Program

Retired and Senior Volunteer Program (RSVP)

The Retired and Senior Volunteer Program (RSVP) capitalizes on Washington’s senior population’s skills and energy for community improvements.

Resource

Rights-of-Way Safety Initiative

During the 2022 legislative session, Gov. Inslee submitted a proposal to the Legislature to deliver housing and services to individuals and families living in certain […]

S

Program

Safe Storage Program

Supported by the Legislature, the Office of Firearm Safety and Violence Prevention received $1 million in state funding to support safe storage suicide prevention outreach […]

Program

Safety and Access for Immigrant Victims Program

Commerce’s Safety and Access for Immigrant Victims initiative aims to promote and provide consistent, equal protections to immigrants who are victims of a crime.

Program

Section 811 Project Rental Assistance Program

The HUD 811 Project Rental Assistance (PRA) grant was awarded to Commerce by the federal Office of Housing and Urban Development (HUD). This grant will […]

Resource

Sexual Assault Response Best Practices

The Office of Crime Victims Advocacy created two documents to assist communities with accessing nurses who serve sexual assault victims.

Resource

Short Course on Local Planning

The Short Course on Local Planning offers an overview of land use planning laws in Washington, an introduction to comprehensive planning and plan implementation under the Growth Management Act (GMA), a review of roles in planning, and mandatory training on the Open Public Meetings Act and Public Records Act for local government officials. All courses are offered at no charge and are open to the public.

Group

Small Business Resiliency Network (SBRN)

Small businesses require capital to grow. We offer your growing business several loan programs designed just for small businesses, to help you purchase new equipment, renovate, expand […]

Unit

Small Business Training and Education Center

Like going to business school, but better. Our goal is to provide the tools, resources, education, training and support you need to build your successful […]

Program

Solar for All

Solar for All grant funding to make solar energy accessible to income-qualified Washingtonians.

Unit

Special Initiatives

The Special Initiatives Unit implements new legislative priorities to ensure everyone in Washington has access to safety, belonging, and the basic resources needed to thrive.

Group

State Advisory Council on Homelessness (SACH)

SACH is a 12-member governor-appointed advisory council created by executive order in 1994. It was revised by Executive Order 15-01 in 2015. It also includes […]

Resource

State Agency Fleet EVSE (SAFE) Tool

As part of Washington state’s continued efforts to reduce greenhouse gases (GHG), RCW 47.01.520 directs a multiagency effort to create tools that enable a timely […]

Program

State Crisis Intervention Program (SCIP)

Funding strategies to improve implementation and enforcement of laws for court-ordered firearm surrender and prohibitions. The DOJ Byrne State Crisis Intervention Program (SCIP) is a […]

Resource

State Efficiency and Environmental Performance (SEEP)

Executive Order 20-01 created the State Efficiency and Environmental Performance (SEEP) Office. SEEP works with state agencies to achieve reductions in greenhouse gas emissions and […]

Resource

State Fleet Vehicle Electrification

State fleet vehicles are a major contributor to greenhouse gas (GHG) emissions. To meet GHG limits established in RCW 70A.45.050, state agencies need to transition […]

Program

State Home Electrification and Appliance Rebates Program (HEAR)

The State Home Electrification and Appliance Rebates Program provides grants to eligible third-party administrators to provide rebates and incentives to households and small businesses to […]

Program

State Home Energy Assistance Program (SHEAP)

State Home Energy Assistance Program (SHEAP) helps people in Washington pay their utility bills and move to low-to-no carbon heating and cooling options.

Resource

State Homeless Grants

Homelessness impacts thousands of adults and families with children in Washington. Every year the Washington State Legislature sets aside funding for Commerce to distribute in […]

Program

State Project Improvement Grants Program (SPI)

State Project Improvement (SPI) grants provide funding for state agencies to redesign building projects to increase energy efficiency and environmental performance. Funding covers the additional […]

Resource

State Strategic Plan, Annual Reports and Audits

Commerce is responsible for a State Strategic Plan and Annual Report to the legislature on Washington state’s efforts to address homelessness. The plan is a […]

Program

State Surplus Program

The cost of land in Washington makes affordable housing construction a challenge for developers. One solution is to use state agency owned land that has […]

Resource

Submitting Documents to the State

Building Washington’s future requires effective coordination between state and local government. This page provides guidance on submitting notices to Commerce.

T

Resource

Technical Assistance Report

“Time, Trust, Technology: community first for small business success”, is a first-of-its-kind comprehensive study to document the services available to help small businesses succeed and […]

Program

Tenancy Preservation Program

Washington State’s Tenancy Preservation Program (2019 amendments to RCW 59.18.410(3) and 43.31.605(c)) became effective on June 29, 2019. The program reduces homelessness by providing relief […]

Program

Tenant Notices for Prepayment of Federally Assisted Properties

Pursuant to RCW 59.28, owners of federally assisted rental housing are required to give tenants a 12-month notice before prepayment of a federally insured mortgage […]

Program

Tenant-Based Rental Assistance (TBRA)

The HOME Tenant-Based Rental Assistance (TBRA) program utilizes Federal funds to support communities by providing utility, deposit and ongoing rental assistance. Commerce TBRA funds are […]

Resource

Training and Tools for Recipients of Housing Funds

Washington is committed to safe, decent and affordable housing for all residents. While housing affordability and wealth inequality are leading causes of homelessness, we also […]

Resource

Transfer of Development Rights (TDR)

Transfer of Development Rights (TDR) is a market-based mechanism that encourages the voluntary transfer of growth from areas a community wants to conserve to urban areas where growth should be encouraged, consistent with GMA goals.

Resource

Transit-Oriented Development

Transit-Oriented Development (TOD) is a type of land development that maximizes the amount of residential, commercial and activity space near public transportation. It reflects the […]

Resource

Transportation Electrification Strategy (TES)

The Washington EV Council developed a statewide Transportation Electrification Strategy (TES) intended to ensure electric vehicle incentives and infrastructure are accessible and available to all […]

Resource

Transportation Planning

The Growth Management Act (GMA) requires the transportation element to implement and be consistent with the land use element. Counties and cities should use consistent […]

Program

Tribal Climate Resilience Program

Climate change impacts different tribes in different ways, depending on their unique geography, culture and economy. Commerce has consulted with tribes in Washington to co-design […]

Resource

Tribal Planning

The Growth Management Act requires some cities and counties to include a climate resilience element within their comprehensive plans. Many tribes have their own comprehensive […]

U

Resource

Updating GMA Housing Elements

Cities and counties planning under the Growth Management Act (GMA) must include a housing element in their comprehensive plans. The GMA housing goal directs local […]

Resource

Utility Extreme Heat Shutoff Moratorium

Utility Extreme Heat Shutoff Moratorium (House Bill 1329) prohibits electrical and water companies from involuntarily terminating utility service to any residential user due to lack […]

Resource

Utility Resource Plans

Washington law (RCW 19.280) requires all electric utilities to create and regularly update resource plans. These plans help estimate how much electricity will be needed […]

V

Program

Violence prevention with CRP

The Legislature identified violence reduction as one program area to focus Community Reinvestment funding, specifically focusing on “community-based violence intervention and prevention services.”

W

Group

WA Statewide Human Trafficking Task Forces

In Washington state, there are three tasks forces that are working to identify the resources needed to address human trafficking. This includes looking at services, public policy, and the ways that the various systems and supportive services are working together.

Group

WA-EOP Commission

The Commission operates as an Advisory Board to the Washington Employee Ownership Program (EOP). Meeting quarterly, the commission will offer input and recommendations to the […]

Resource

WA-EOP Tax Credit

Beginning July 1, 2024, an occupation tax credit for costs related to converting a qualifying business to an employee ownership structure is established. The total […]

Group

Washington Child Care Collaborative Task Force (C3TF)

The Child Care Collaborative Task Force (C3TF) was created by the Washington State Legislature in 2018 (SHB 2367) to develop policy recommendations to incentivize employer-supported […]

Program

Washington Employee Ownership Program (WA-EOP)

Ongoing support Until funding is renewed, the Department of Commerce’s ability to administer the Washington Employee Ownership Program and convene the Employee Ownership Commission sunset […]

Program

Washington EV Instant Rebate Program

The Washington State Department of Commerce’s EV Instant Rebates Program is now closed. All 2024 funds have been claimed. Income verification To ensure program funds […]

Program

Washington Families Clean Energy Credits Grant Program

Up to 675,000 Washington households will see electricity bills reduced by $200 thanks to the state Climate Commitment Act. The Washington Families Clean Energy Credits […]

Unit

Washington State Broadband Office (WSBO)

In recognition that broadband access is critical to the residents of Washington, RCW 43.330.532 established the Washington State Broadband Office (WSBO) and tasked it with […]

Resource

Washington State Energy Strategy

Avoiding the worst impacts of climate change requires a comprehensive commitment to decreasing greenhouse gas emissions. Washington launched initial efforts with legislation to require clean […]

Resource

Washington State Zoning Atlas (WAZA)

The Washington State Zoning Atlas (WAZA) will be a publicly available mapping tool illustrating key features and regulatory characteristics of zoning codes across jurisdictions in […]

Program

Washington Statewide Reentry Council

The Washington Statewide Reentry Council advocates for Washington state laws, investments, and attitudes that improve reentry outcomes, increase public safety and build systems that are more humane and restorative.

Unit

Weatherization

Boost energy efficiency: Financial assistance for low-income homeowners and renters. The Weatherization Program offers cost-effective energy efficiency and related repairs to reduce energy bills and […]

Program

WorkFirst Commerce

Commerce WorkFirst is Washington state’s welfare reform program designed to help Temporary Assistance for Needy Families (TANF) participants become self-sufficient.

Y

Resource

Youth Homelessness Prevention

OHY leads youth homelessness prevention efforts by collaborating with various partners to coordinate systems and services as a central component to ensuring safe and stable housing.

Program

Youth Recreational Facilities Program

State grants are available to nonprofit organizations to help defray eligible capital costs for acquisition, construction and renovation of nonresidential youth recreation facilities.

Z

Resource

Zero Energy Toolkit

The guidance by building steps and resource links are intended to assist in the development of a Zero Energy (ZE) or Zero Energy-Capable (ZE-C) buildings […]