Local Government Fiscal Note Program

Founded by the Legislature in 1977, the Local Government Fiscal Note Program helps elected leaders understand the fiscal impacts that proposed state legislation could have on counties, cities, and most special purpose districts. Our experienced team of analysts produces the largest number of fiscal notes of any state agency.

Last Session's Local Government Fiscal Note Count

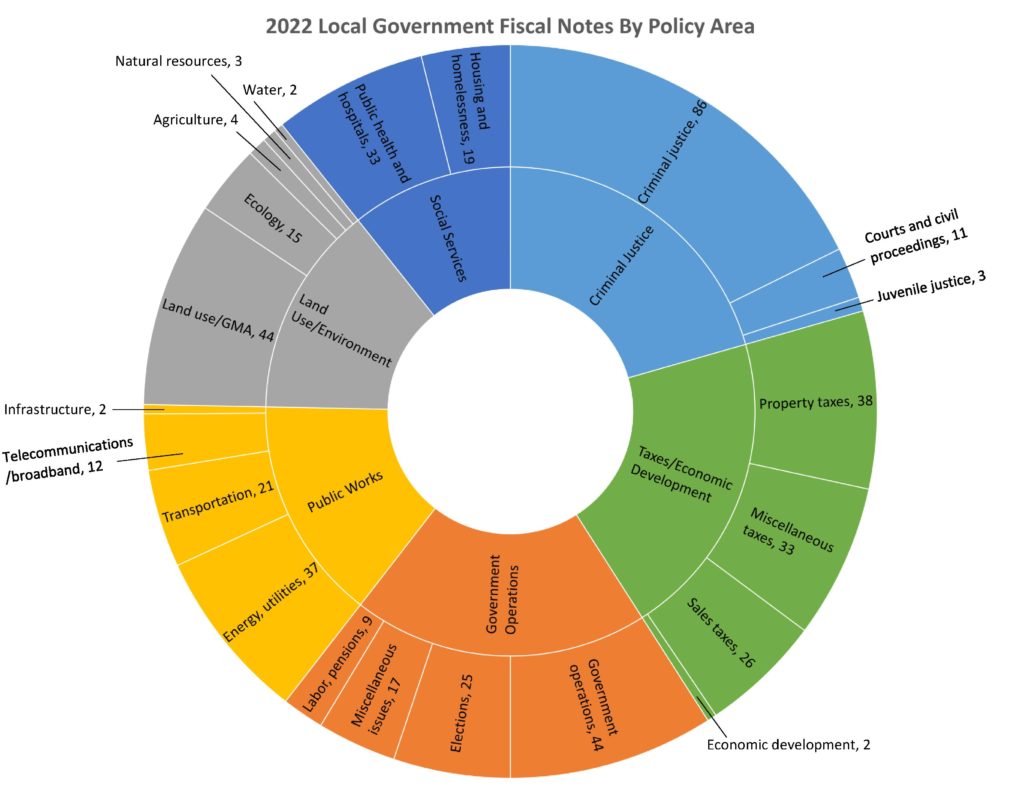

In 2022, Commerce’s LGFN analysts wrote fiscal notes in many local government policy areas. The sunburst chart below shows the number of fiscal notes produced in 2022 per policy area.

Among the 486 local government fiscal notes completed, 100 fell under the umbrella of Criminal Justice (the highest volume of notes in a policy area). Examples of proposed legislation dealt with developing a process for vacating convictions as well as refunding legal financial obligations in accordance with the 2021 decision in State v. Blake.

The next highest volume of fiscal notes in a policy area was 99 fiscal notes in Taxes and Economic Development. Examples of proposed legislation concerned topics like sales and use tax deferrals for local governments involved in clean technology manufacturing, and changes to the allocation of funds in the state’s waste reduction, recycling, and litter control account.

The remaining policy area fiscal note counts in 2022 included 95 Government Operations notes, 72 Public Works notes, 68 Land Use/Environment notes, and 52 Social Services notes.

Frequently Asked Questions

How are local government fiscal notes used?

Our notes are used by legislators and the public prior to hearings and updated as bills are modified. Local government fiscal notes are part of a larger fiscal note packet sent to the policy and appropriations committees of each house and available to members of the public online.

Do you cover all local jurisdictions?

We cover counties, cities, and most special purpose districts. Our notes include prosecution and defense costs but not other court-related costs, which are addressed by the Administrative Office of the Courts. The Office of the Superintendent of Public Instruction assesses impacts on school districts.

What is the range of topics you cover?

We address almost any issue that could impact local governments. Some examples are taxes, criminal justice, economic development, land use, social services, natural resources, government operations, elections, and public works. That is why we possess a broad range of policy experts.

How do you assess fiscal impacts?

Fiscal impacts of legislation are determined through surveys, data models, review of published reports and online databases, and direct consultation with state and local government officials. Fiscal note analysts also work closely with local government associations (see right sidebar).

What are the Local Government Fiscal Note Program’s enabling statutes?

Washington’s local government fiscal note process was established in 1977 through 43.132 RCW. Local government fiscal notes provide the Legislature with the information it needs to uphold 43.135.060 RCW. This statute requires the state to mitigate the impact of legislation that requires local governments to create or expand services if these costs are not reimbursed through specific state appropriations or increases in state distributions of revenue to local governments enacted after January 1, 1998.

How are your notes different from those of other state agencies?

Our fiscal notes analyze the cost impacts on hundreds of local governments at the municipal, county, and special district level while other state agency notes focus only on their operation costs. State statute gives us five days to respond to fiscal note requests from the Office of Financial Management, while the statutory deadline for agency notes is three days.

Do other states have a similar program?

Yes. We are one of 42 similar programs across the United States.

Research Services

About our staff

Fiscal Note resources

Local data sources

American Planning Association Washington Chapter

Association of Washington Cities

Association of Washington Public Hospital Districts

Washington Association of County Officials

Washington Association of Prosecuting Attorneys

Washington Association of Sheriffs & Police Chiefs

Washington Defender Association

Washington Financial Officers Association

Washington Public Utility Districts Association

Washington State Association of Counties

Washington State Association of County Treasurers

Need assistance?

Alice Zillah, Research Services Manager

alice.zillah@commerce.wa.gov

Phone: 360-725-5035

Allan Johnson

allan.johnson@commerce.wa.gov

Phone: 360-725-5033